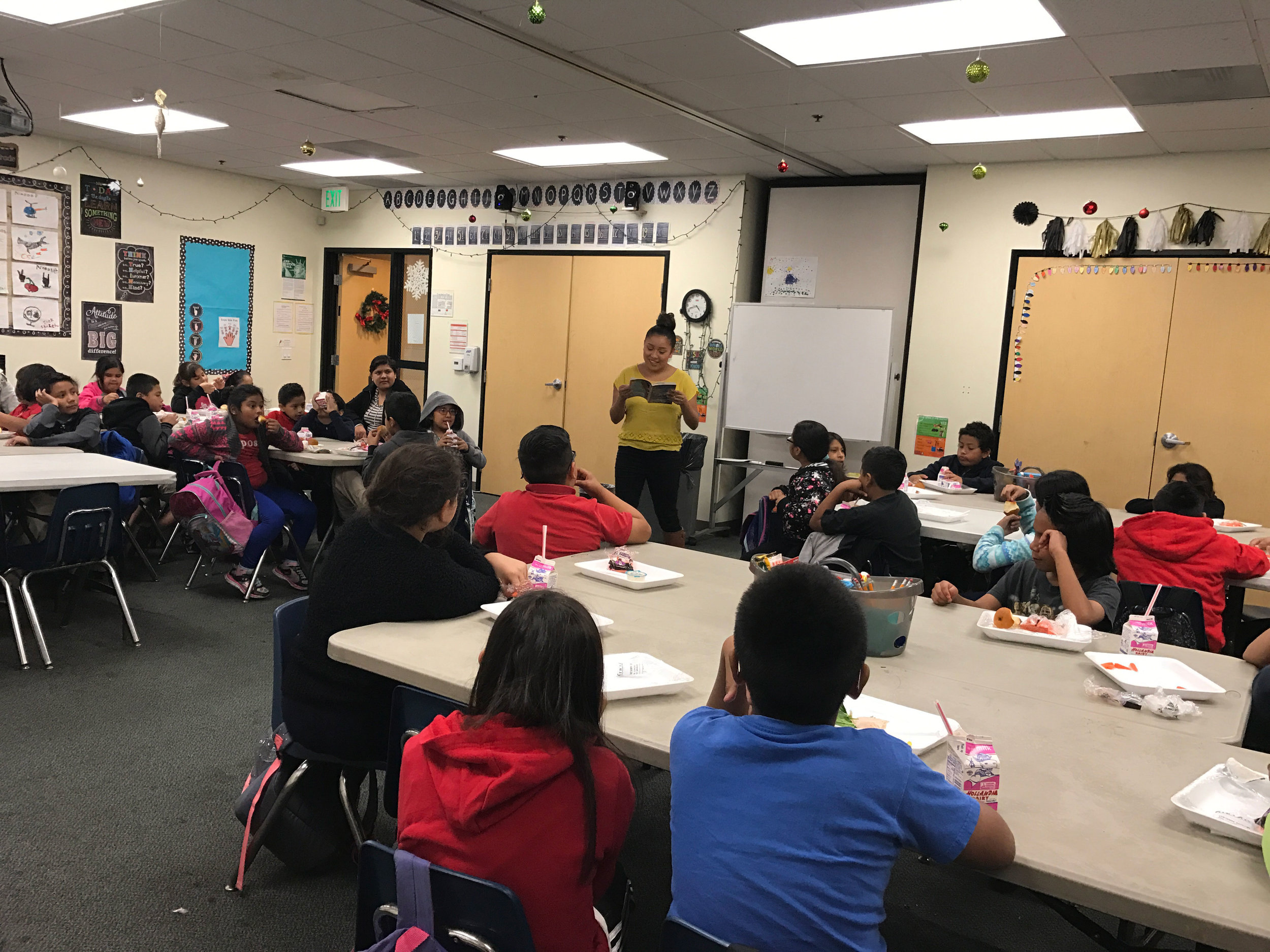

Whether you need to give a gift for the person who has everything, make a meaningful year-end charitable contribution, or simply want the warm feeling of supporting a KidWorks student, there are several ways to give the gift of education to a student at KidWorks that can also provide meaningful tax savings to the donor.

Here are some simple ways you can give The Gift of Education to A student at KidWorks:

IRA Rollover Gifts:

If you are age 70 1/2 or older, you can give KidWorks up to $100,000 from your IRA account by using the Charitable Distribution Provision, even if that gift is more than your annual Required Minimum Distribution (RMD). The direct transfer will not be included in your taxable income, and, therefore, you would not have to pay tax on the direct transfer to KidWorks. Instead of giving $10,000 per year over the next five years, you would give $50,000 in one year, taking you above the new standard deduction and thus providing a tax benefit for your contribution. An added bonus is that these direct transfers to KidWorks count toward satisfying your required minimum distribution for the year. Bear in mind though that these direct transfers must come from IRAs; they cannot come from 401(k)s.

Stacking or Lumping Gifts:

Another option to make a charitable donation and still get the tax benefit is to stack or lump your charitable giving.

Gifts of Stocks, Bonds, CDs, & Mutual Funds:

Gifts of stocks, bonds and mutual funds are a great way to support KidWorks that can provide significant year-end tax savings to the donor. By donating stocks or other securities, you can avoid paying capital gains tax that would otherwise incur if you sold these assets. Be sure that you have owned the shares at least 12 months and one day (the IRS definition of “long-term”) and that the stock has appreciated.

The benefits available to you when making a charitable contribution of stock or mutual funds may include:

Avoiding federal and state tax on the capital gain;

Receiving an income tax deduction (federal and most states) for the full market value of the gift if you itemize deductions on your tax return and have held the assets one year or longer;

Making a larger gift at a lower original cost to you.

Donating A Vehicle:

If you have an extra vehicle that you no longer need, make the most of it by donating that car, truck or boat to KidWorks. We will secure top dollar for your extra car, and you can support the KidWorks Mission. Call (714) 834-9400x133 to learn more.

Your gift to KidWorks is an investment that immediately impacts the students and community we serve.

We recommend that you review these ideas with your financial advisor or CPA to determine what strategy is best for you to achieve year-end tax savings while supporting KidWorks. As always, we take the privacy of our donors very seriously, click here to read our Donor Privacy Policy and the Donor Bill of Rights. If you have any questions, don't hesitate to contact a member of our development team.

Note: KidWorks Community Development Corporation cannot give tax or legal advice. Please consult your own professional tax advisor about the best way to take advantage of any giving opportunity.